From Reporting to Action: Turning ESG Disclosures Into Real Impact

Sustainability & ESG / October 8, 2025

By Grayson Murphy, Sustainability Specialist

For many companies, ESG disclosures are just treated as an exercise in corporate responsibility and compliance. But, when done thoughtfully, ESG reporting is far more than a requirement.

It’s a strategic asset that can influence management decisions, shape culture, guide budgeting, and lead to measurable change year over year. OBATA helps businesses turn these reports from static documents into a dynamic force for business value and impact.

What ESG Disclosures Include

ESG disclosures are one of the most well-known forms of sustainability reporting for companies across all industries and sectors. An ESG report covers environmental, social, and governance topics. Many of the sustainability metrics analyzed and discussed in ESG reports closely resemble the 17 Sustainable Development Goals introduced by the U.N. As a result, ‘ESG reporting’ and ‘sustainability reporting’ have become widely used interchangeably.

Learn more about the ESG reporting process in our 7-Step ESG Reporting Process guide.

CLARIFYING THE TERMS

What is the difference between ESG reporting and sustainability reporting?

While ESG reporting and sustainability reporting are often used interchangeably, ESG focuses on specific environmental, social, and governance metrics, whereas sustainability reporting has a broader scope, often including the company’s overall impact on people and the planet.

Sustainability Reporting Impacts

Financial

Sustainability reporting can introduce lucrative opportunities to identify inefficiencies and cost savings in the supply chain and in business practices. In a 2024 survey report by DNV, 40% of 525 respondents reported revenue growth from implementing sustainability initiatives in their supply chain, and 34% saw cost savings.

- From the Scope 1 perspective, introducing LED lighting in office and warehouse spaces is one of the most common ways companies can see financial gain from sustainability initiatives.

- LED lighting uses significantly less energy than traditional fluorescent lighting helping to reduce energy costs overall. It also requires less maintenance over time and produces less ambient heat which minimizes the impact on a building’s heating and cooling systems. All of these factors lead to more money saved.

Appealing to more investors is another way that ESG disclosures can present companies with the opportunity for financial gain. Increasingly, investors are more interested in ethical investing practices which prioritize factors related to a company’s sustainability alongside the potential monetary upside from investment.

Specifically, ESG funds, which consider environmental, social, and governance factors, are growing in popularity.. Companies who are more compliant to current regulations and have lower carbon footprints are more likely to be resilient to future environmental and social challenges leading to less volatility in their stock shares.

People and Culture

Engaging local communities provides more company support and a healthier environment for employees. By focusing on the ‘social’ aspects of ESG reporting, companies can reap these benefits.

- When employees are healthy and mentally sound, their motivation, focus, and job satisfaction naturally increase, leading to fewer sick days and enhanced job performance.

- This leads to increased efficiency and cost savings.

- Leading with transparency and collaboration also helps businesses engage a different set of stakeholders, leading to greater business buy-in and faster solutions.

- Creating diverse, equitable, and inclusive work environments boosts creativity, innovation, and problem-solving.

Compliance

Some businesses are now required to report on sustainability to comply with regulations. In Europe, companies must follow the Corporate Sustainability Reporting Directive (CSRD), while in the U.S., large companies operating in California will soon need to comply with SB 261. Even if disclosures are not yet mandatory, investing in ESG reporting early can make future compliance far easier. Beyond regulation, setting measurable, time-bound Science-Based Targets (SBTis) helps businesses strengthen resilience against climate change and other unforeseen risks.

Avoid common reporting mistakes that can undermine ESG credibility in Sustainability Reporting Pitfalls and How to Avoid Them.

Brand and Reputation

Sustainability reporting helps companies avoid misleading claims and the risk of a ruined reputation. For customer-dependent businesses, avoiding greenwashing is key to maintaining a strong brand image.

Reporting can also set companies apart from competitors especially in markets where sustainability reporting is in the early stages.

In industries like fashion, retail, and mining, ESG disclosures may not be readily available due to the lack of regulations or data inaccuracies and unavailability within supply chains. Companies that choose to report on sustainability can position themselves as early adopters and industry leaders.

See how to communicate your ESG progress effectively in Turning Sustainability Data Into Brand Storytelling.

EXECUTIVE INSIGHT

How can ESG reporting drive financial value for my company?

ESG reporting can uncover cost savings in the supply chain, attract investors interested in ESG funds, and enhance brand reputation — all of which contribute to long-term business resilience and profitability.

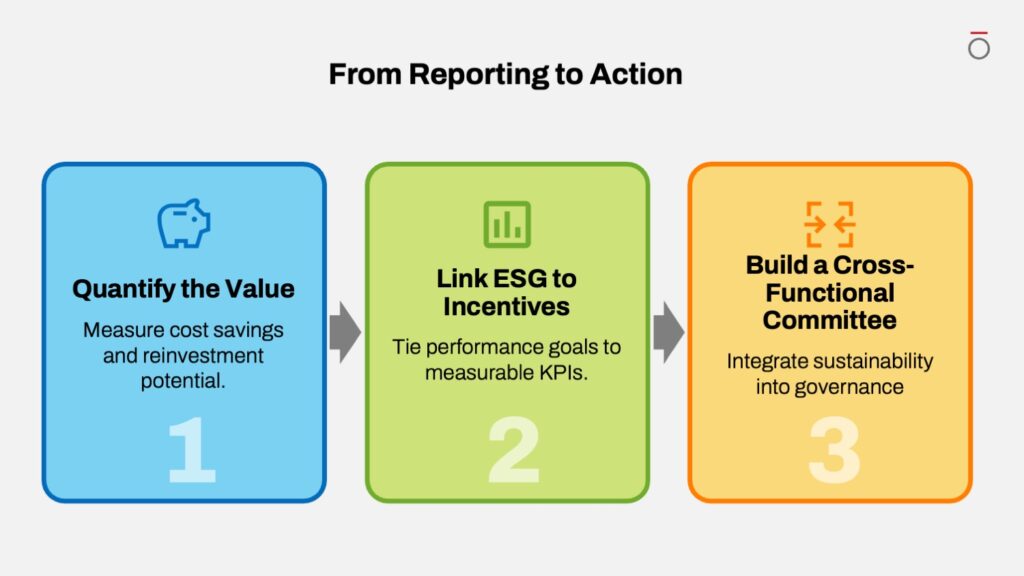

Three Steps to Turn Sustainability Disclosures into Real Impact

- Quantify the Value: Analyze the cost savings and value created through sustainability initiatives, then use that data to make the case for reinvestment and additional resources.

- Link ESG to Incentives: Tie executive and employee compensation to measurable, time-bound sustainability KPIs. Embedding these goals into performance management strengthens governance and accountability.

- Build a Cross-Functional Committee: Establish a sustainability committee that brings together expertise from environmental, legal, and finance teams. This ensures risks, opportunities, and impacts are examined from all angles and integrated across the business.

Take the Next Step

Ready to move beyond reporting to measurable results? Our corporate reporting and sustainability consulting services can help you transform compliance into a competitive advantage.