Greenwashing: What It Is and How to Avoid It

Sustainability & ESG / September 9, 2025

By Grayson Murphy

Greenwashing vs. Genuine ESG Commitments: How Investors and Regulators are Cracking Down on Misleading Sustainability Claims

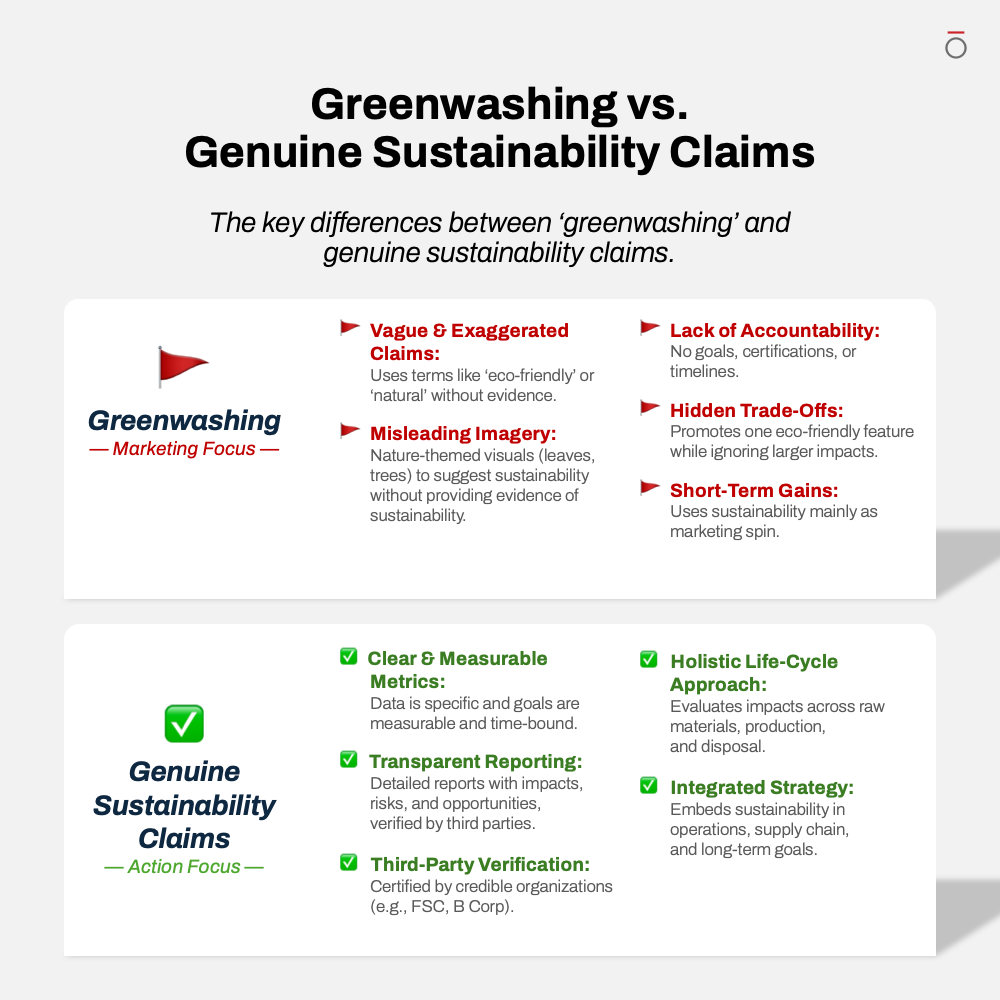

Let’s face it: Not all sustainability claims are equal. Some businesses genuinely embed sustainability into their operations, while others engage in greenwashing, whether intentionally or unintentionally.

Greenwashing misleads consumers, investors, and stakeholders about the actual environmental and social impact of a company, making it appear to be more sustainable than it actually is.

The Greenwashing Problem

What Greenwashing Looks Like

Greenwashing occurs when a company exaggerates, misrepresents, or fabricates its ESG efforts to appear more sustainable without making meaningful environmental improvements. This can take many forms, including:

- Vague or Unsubstantiated Claims:

Using broad terms like “eco-friendly” or “carbon-neutral” without clear data or third-party verification.

- Selective Disclosure:

Highlighting one positive ESG initiative while ignoring more significant negative impacts.

- Symbolic Gestures Over Real Action:

Investing in marketing campaigns about far away sustainability targets without meaningful operational changes.

Other vague messaging keywords often associated with greenwashing include:

- “Sustainably sourced” with no associated certification

- “Biodegradable” or “compostable” without specifying the required conditions (residential vs. commercial composting)

- “Net-zero” or “zero emissions” without clarifying a scope or timeline

- Unsupported and unexplained adjectives like “clean,” “green,” “pure,” and “ethical”

Companies often use nature imagery and earthy colors in products and marketing to suggest eco-friendliness, another common greenwashing tactic. Not only are these tactics misleading, but they also hamper real sustainability progress by confusing stakeholders and diverting attention away from companies that are genuinely reducing their impact.

The Cost of Greenwashing

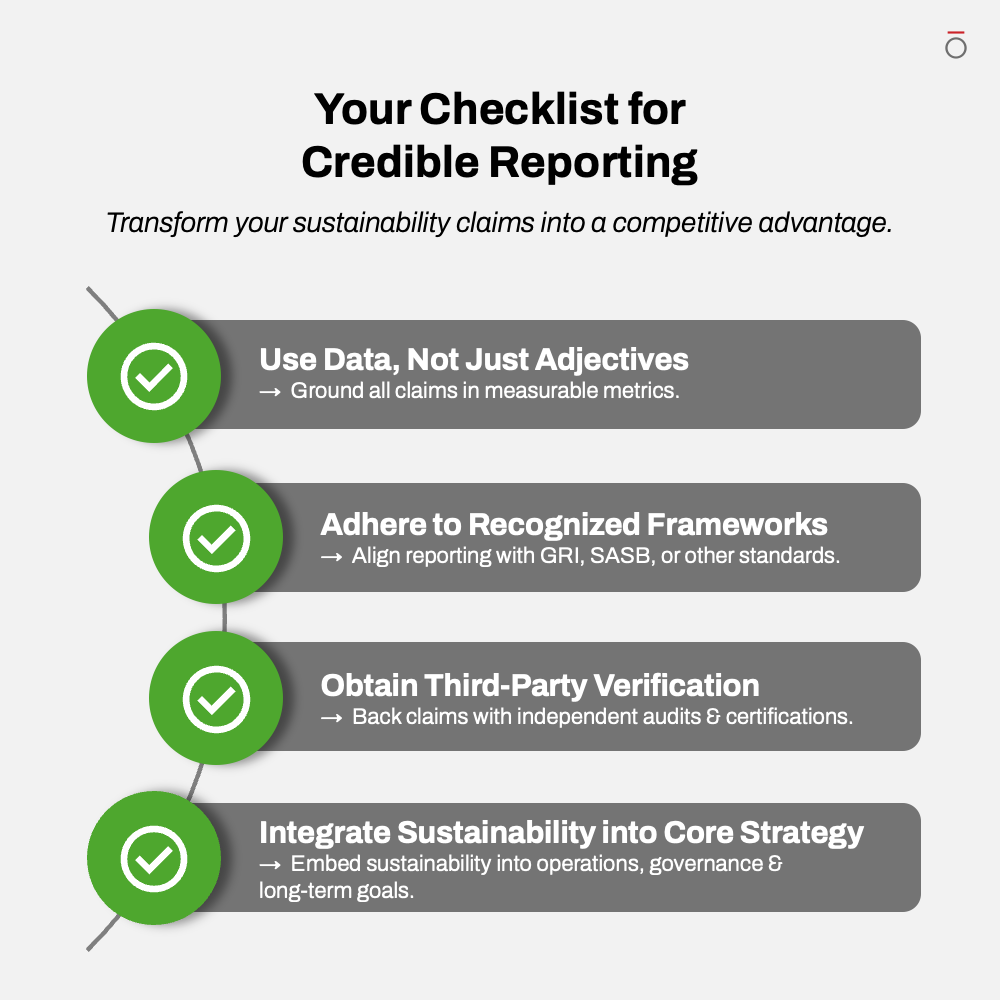

To avoid greenwashing, companies should use specific, time-based, transparent, and verifiable statements. For example:

- A product may be labeled “made from 100% FSC certified materials,” demonstrating that their sustainability claims have been verified by a credible third party.

- For B2B companies, a statement like “We cut scope 1 and 2 emissions by 18% from our 2020 baseline, verified by a third-party audit, and are on track to meet our SBTi-approved 2030 targets”.

A good spot to look for B2B sustainability claims is in the company’s publicly available annual ESG report, such as those created by OBATA.

Regulatory and Reputational Risks

Regulatory Crackdowns on ESG Misrepresentation

Governments and financial regulators worldwide are introducing stricter ESG disclosure requirements to curb greenwashing. Certain corporations that do business the UK and EU are subject to the following requirements:

- Corporate Sustainability Reporting Directive:

Requires large corporations to publish annual reports on their social and environmental risks and impacts. This reporting is expected to be enforced by law in the EU in 2027 for the risks and impacts occurring in 2026.

- EU Green Claims Directive:

Targets misleading environmental claims in corporate marketing and aims to ensure that “green claims” are reliable, verifiable, and comparable. This directive has been withdrawn from the legislative process, by the EU Commission, for the time being.

- UK’s FCA Sustainability Disclosure Requirements:

The anti-greenwashing clauses in these requirements ensure that financial firms provide clear, accurate, and fair sustainability statements. The FCA aims to increase customer trust and transparency with these regulations and firms may face litigation and regulatory action, like fines or restrictions, if they fail to comply.

At present, in the U.S., there are no federally mandated sustainability reporting requirements. In 2024 the SEC proposed climate disclosure rules requiring disclosure of climate related risks and greenhouse gas emissions at the corporate level. However, defense of these rules was officially withdrawn from litigation by the SEC in 2025 and the future of the SEC’s climate disclosure rules remains uncertain.

Some state-level legislation has emerged, such as California’s SB 219, which notably requires that large corporations report on their scope 1, 2, and 3 emissions and that the data be third-party verified. While some companies may claim to be planet-friendly, CA SB 219 is an example of how systemic GHG disclosure requirements can require companies to validate those claims helping to curb instances of greenwashing.

It should be noted that while some of these requirements and directives may be on hold, or still in development, it is important for companies to start to become familiar with these standards of sustainability reporting in order to prepare for the future success of their business.

Reputational Risk

Consumers today are often more informed and skeptical of sustainability claims. Companies caught greenwashing face brand damage, lawsuits, and public backlash.

The 2022 H&M class-action lawsuit is an example of a large-scale greenwashing scandal and a brand facing public backlash. H&M was being sued by the plaintiffs of the case over their misleading sustainability labeling and marketing ploys. The case also alleged that H&M falsified the sustainable nature of their products and their recycling techniques. While the 2022 case has since been dropped by the plaintiffs, the fast-fashion industry as a whole continues to be under fire for their use of greenwashing tactics and their lack of standardized sustainability practices.

A recent B2B example features Danimer Scientific, Inc., which faced a lawsuit from investors after it was found that their environmental sustainability claims may have been untrue. The company claimed that their plastic substitute product, Nodax, was completely biodegradable in oceans and landfills. After this was found not to be the case, public backlash saw Danimer stock prices plummet. In such examples, not only is the health of the planet at risk, but so is the health of the company, as a consequence of greenwashing tactics.

Other forms of greenwashing may happen on a smaller scale but are still harmful in their impact. For example, many products may say “please recycle” or “recycle me” but they are made from materials that are often difficult to recycle, or unable to be recycled in some regions.

Building Genuine Commitments and Trust

How to Spot Genuine Commitments

Look for the following information on company websites, official communications, or sustainability reports if possible to help determine if genuine sustainability commitments and actions have been taken:

- Key ESG indicators:

Greenhouse gas emissions, water use, company diversity and human rights, waste and waste diversion, energy use, anti-corruption policies, occupational health and safety, contribution to local communities, and more are generally included in GRI based reporting, the gold standard of corporate sustainability reporting.

- Science-Based Targets:

Companies aligning with initiatives like the Science-Based Targets Initiative (SBTi) are more credible.

- Audits/Third-Party Verification:

ESG claims should be backed by independent auditors and certifications (e.g., B Corp, LEED, GRI).

- Comprehensive Reporting:

Businesses should disclose both positive and negative sustainability impacts.

- Integration into Business Strategy:

ESG should be embedded in core operations, supply chain decisions, and executive compensation plans, not just marketing.

How OBATA Can Help

Avoiding greenwashing and building trust requires a credible, data-driven approach to sustainability reporting. Our team has helped clients report on their sustainability efforts for more than 25 years. We apply a proven methodology to showcase your genuine ESG progress. From initial materiality assessments to final report design, we support your team through the entire process, ensuring your claims are verifiable and compelling.

Contact OBATA to learn how we can help your business navigate greenwashing pitfalls and build a trustworthy reputation.