Embracing Double Materiality in Sustainability Reporting

Sustainability & ESG / May 20, 2025

By Mary Riddle

Sustainability reporting is in the midst of a transformation as companies are no longer just assessing how ESG factors affect their financial performance. They must also evaluate their own impact on society and the planet.

This concept, known as double materiality, is becoming a core principle in global sustainability reporting frameworks, particularly under the European Union’s Corporate Sustainability Reporting Directive (CSRD).

But what exactly is double materiality, and why does it matter? In this post, we’ll break down this shift, its implications for businesses, and how companies can prepare for this new reporting requirement.

What Is Double Materiality?

Traditionally, financial materiality has been the main lens through which businesses assess risks and opportunities. In this approach, a company reports on ESG issues only if they have a financial impact on the business.

For example, a ski resort might report on how climate change affects their ability to operate profitably in the face of warming winter temperatures.

Double materiality expands this view by introducing impact materiality, which requires companies to disclose how their activities affect people and the environment, even if those impacts do not directly affect their financial performance.

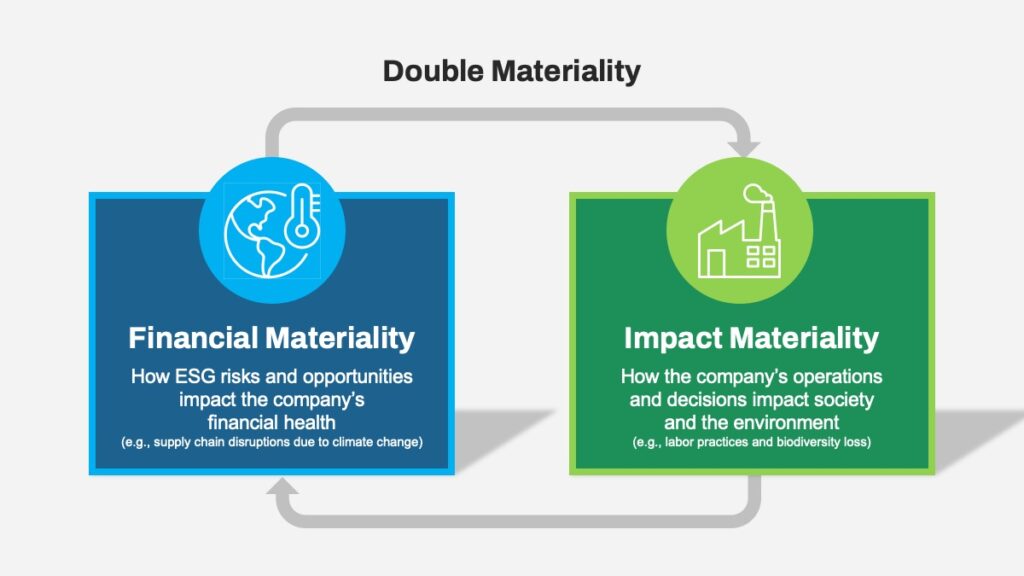

This means businesses must evaluate:

Financial Materiality

How ESG risks and opportunities impact the company’s financial health (e.g., supply chain disruptions due to climate change).

Impact Materiality

How the company’s operations and decisions impact society and the environment (e.g., labor practices and biodiversity loss).

While frameworks such as the Global Reporting Initiative (GRI) have long incorporated impact materiality, CSRD is a major force behind the push for double materiality.

The EU’s new sustainability reporting rules require companies to assess both financial and impact materiality, covering a broad range of ESG topics. However, for many companies and industries outside of the scope of CSRD, investors, consumers, and regulators increasingly expect companies to demonstrate accountability for their broader impact, not just financial performance.

The Business Implications of Double Materiality

Enhancing Data Collection Methods

The push toward double materiality necessitates companies significantly enhancing their data collection methods. Organizations must gather comprehensive data on their ESG performance, monitoring their carbon footprint, social impact, and governance policies.

This involves implementing better supply chain transparency, fostering collaboration with diverse stakeholders, and utilizing advanced data analytics tools. By improving these processes, businesses can ensure their reporting reflects a complete and accurate picture of both financial and impact materiality.

Building Stakeholder Accountability

Embracing double materiality creates pathways for improved stakeholder accountability. Companies are expected to not only disclose how ESG risks and opportunities affect their financial health but also to highlight their operations’ impact on society and the environment.

By acknowledging and addressing these concerns, organizations can build trust with stakeholders, including consumers, investors, and communities.

Strengthening Brand Reputation and Trust

Even for organizations outside the scope of the CSRD, early adoption of double materiality can enhance brand reputation and attract green investments. Companies that commit to transparent, comprehensive reporting distinguish themselves in a competitive marketplace.

By demonstrating accountability for their broader impact, these businesses can foster stronger relationships with stakeholders, bolster their trustworthiness, and position themselves as leaders in sustainability practices.

How OBATA Can Assist You

If your company has not started on a double materiality reporting process yet, we are here to help.

OBATA can assist companies stay ahead of the curve through a variety of service offerings:

Double Materiality Assessment Services

We can help you identify ESG issues that are financially material and those that have a significant environmental or social impact. We will work with you to engage stakeholders, investors, employees, and affected communities to gather diverse perspectives.

Framework and Standard Selection Guidance

We can help you choose which voluntary reporting standards are right for your reporting needs and work with you to align with any regulatory reporting frameworks required.

ESG Data Collection and Management

There is no shortage of digital tools for reporting needs, but which one is right for your company? We can help you evaluate your needs and get your company set up to efficiently track ESG performance.

Corporate Sustainability Strategy Development

We can help you move beyond compliance by embedding ESG goals into corporate strategy, supply chain management, and risk assessment processes.

As regulations evolve and investor expectations increase, businesses that proactively embrace double materiality and transparently report on their financial, environmental, and social impacts will be better positioned for long-term success.

Let us partner with you on this journey toward comprehensive and impactful sustainability reporting.