The 7-Step ESG Reporting Process

Sustainability & ESG, Guides / October 14, 2024

By Paul Gassett

When it comes to producing an Environmental, Social, and Governance (ESG) report, it is crucial to respect the sustainability reporting process, regardless of whether you are a seasoned professional or a first-time report creator.

Depending on your company’s sustainability goals, the process of producing such a report may range from somewhat complicated to extremely complex.

However, no matter where your organization stands in its ESG adoption journey, the process always begins with an evaluation and ends with a report demonstrating the collective efforts of those supporting you and your commitment to ESG.

In this article, we will walk you through the 7 steps that are recommended for developing a successful ESG or sustainability report. The process is broken down into two phases: first, the science and then, the art of developing a report. For each step in each phase, we will provide helpful tips to improve your reporting outcomes.

You will also gain a clear understanding of what ESG reporting is and what it is not.

By the end, you will be well-equipped to create an effective ESG report that aligns with your organization’s sustainability goals.

Skip Understanding ESG Reporting and jump directly to the Reporting Process

This article was updated in January 2024.

Understanding ESG Reporting

What is ESG reporting?

Environmental, Social, and Governance reporting is a voluntary process. Companies commit to making a difference through sustainability measures that positively impact the environment. They also use ethical standards and guidelines to treat their employees, shareholders, and the communities in which they operate.

ESG reports typically convey non-financial information. This includes both qualitative disclosures about topics and quantitative metrics.

What ESG reporting isn’t?

According to the World Bank, ESG and sustainability reporting is not about addressing workplace inequalities like gender and wage gaps or doing a public relations blitz, complying with standard business regulations and just talking about philanthropic efforts. Your company must make efforts in these areas irrespective of your sustainability goals.

Why should a company care about developing and sharing the non-financial measures communicated within an ESG report?

Because in today’s business world, ESG matters to all your stakeholders — including investors. Doing so demonstrates company management’s commitment to transparency about the risks and opportunities your company faces. In fact, a recent analysis on sustainability reporting by The Conference Board recognized that “transparency can help strengthen relationships with employees, customers, suppliers, and local communities.”

Not to mention that more and more companies are including sustainability data within their annual reports because it appears to have a positive impact on the bottom line. According to a 2021 report from the NYU Stern Center for Sustainable Business, “the exponential growth is due in large part to increasing evidence that business strategy focused on material ESG issues is synonymous with high-quality management teams and improved returns.”

Do public and private companies need to create a sustainability report?

Publicly Held Companies

For publicly traded companies, it would appear that if you’re currently not reporting on ESG matters, you’re behind the curve.

In 2023, G&A Institute reported large-cap companies in the S&P 500 approached 100% reporting, with a record 98% publishing sustainability reports in 2022. In fact, mid-cap companies continue to close the reporting gap with 82% publishing reports in 2022, up from 68% in 2021. Mid-cap companies make up the smallest half by market cap of the Russell 1000.

DID YOU KNOW

0%G&A InstituteThe percentage of large-cap companies in the S&P 500 publishing sustainability reports in 2022

Privately Held Companies

For privately held companies, while the information is a bit more difficult to discern, evidence suggests that public companies are leaning on private companies – typically suppliers to their organization – to get their ship in order. “Sustainability reporting is becoming widespread across both public and private sectors…. However, standardizing key elements of sustainability reporting across the public and private sectors is undoubtedly difficult.” (The International Institute for Sustainable Development (IISD))

Private companies operating in the EU may have to comply with ESG reporting standards set by the Corporate Sustainability Reporting Directive (CSRD). The CSRD, adopted in November 2022, mandates non-EU companies with over $190 million (€150 million) revenue from EU operations for two consecutive years to produce a sustainability report. Reporting standards are being developed and compliance is required from 2028. (Harvard Law School Forum on Corporate Governance, Sept. 2023, ESG Reporting for Private Companies)

The Bottom Line

Developing an ESG report or sustainability report is no longer a nice-to-have option, it’s a need-to-have business tool.

RELATED CONTENT

Do you know the difference between ESG reporting and sustainability reporting?

The 7-Step ESG Report Process

In order to start creating an ESG report or sustainability report, it is important to first focus on the scientific aspects of the report. The Science behind the report includes several crucial components that must be addressed before the Art or creative components of the report can take over.

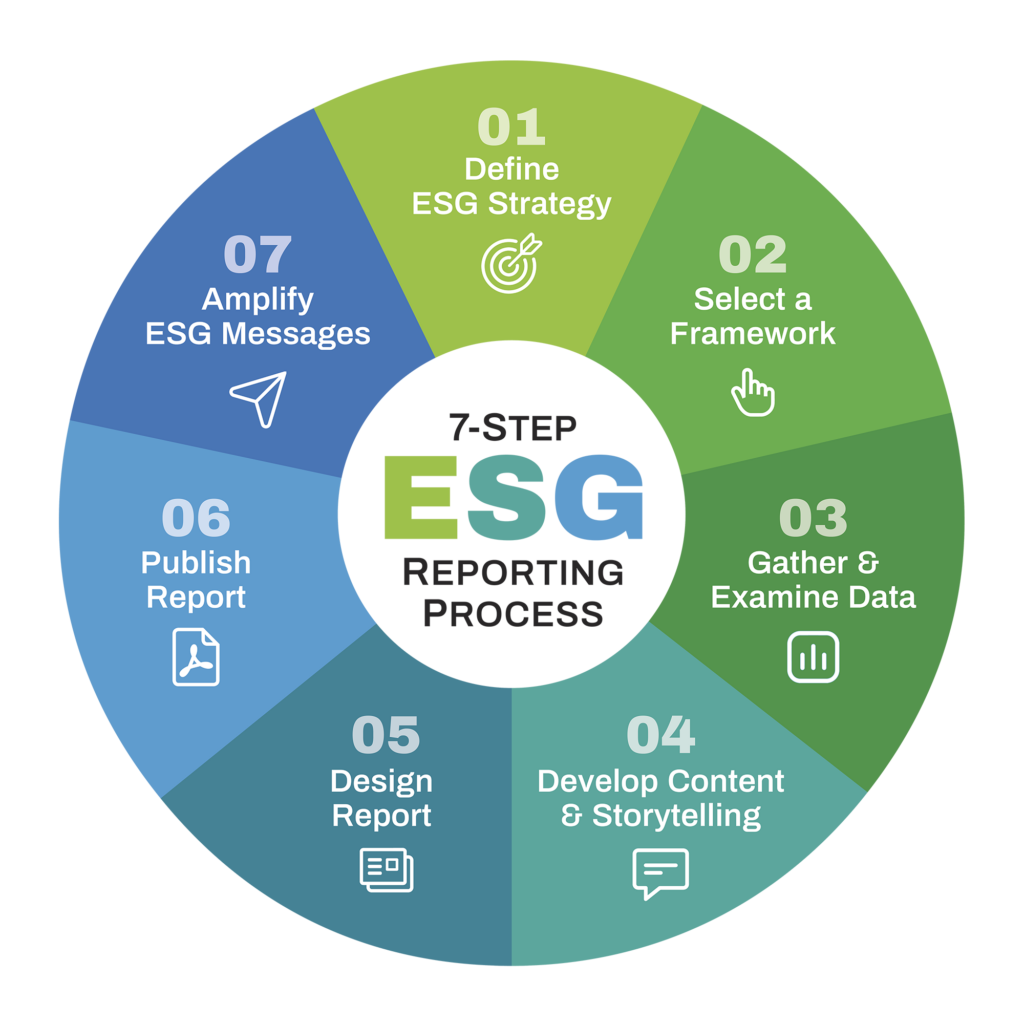

The infographic above breaks down the reporting process into two phases: the science components (steps 1 through 3) highlighted in shades of green, and the art or creative components (steps 4 through 7) highlighted in shades of blue.

Phase 1:

The Science of ESG Reports

The Science of ESG reports is rooted in defining the criteria to measure, and then gathering the data behind your company’s competitive advantage — an advantage born of the efforts to make a difference.

STEP 1: Defining Your ESG Strategy

It’s critical to determine what a successful ESG report will look like for your company. This includes identifying how that success will be measured, when it will be shared, and how it will be communicated. Outlining the key constituents who will receive the information in the ESG report is an important part of this step.

Identifying and defining sustainability initiatives and communicating progress toward meeting your ESG targets is important. Key considerations should include the following:

Stakeholder engagement and materiality assessment:

It is important to identify, contact and gather input from key stakeholders who impact or are impacted by the organization to understand their expectations and identify material topics.

This should be repeated every two to three years for maximum efficacy.

Program development:

This step may include conducting a gap analysis and sector benchmarking to better understand the ESG sector landscape and inform internal goals.

Strategy and goal-setting:

This exercise helps to inform and establish organizational goals and how they impact the company and all stakeholders.

USEFUL TIPS:

- It is helpful to identify several industry sector peers and compare and contrast ratings as well as reporting topics, particularly if this report is your inaugural sustainability report or ESG report.

- Materiality assessment should be repeated every two to three years for maximum efficacy.

STEP 2: Understand and Select Disclosure Frameworks

It is important to start by gaining knowledge about the reporting frameworks. Key decision-makers must be up-to-date on ESG regulations, reporting trends and current events. You may want to consider providing training to key team members so they can work effectively together towards common goals, with a shared understanding and set of assumptions.

Next, select a reporting framework or set of frameworks that makes sense for your organization as well as disclosures associated with them. It’s important to consider the size of your audience and the scope of your reporting.

Commonly used frameworks and disclosure standards:

According to a recent report by the Government & Accountability Institute, some of the most commonly used frameworks and disclosure standards include:

- Global Reporting Initiative (GRI)

- Carbon Disclosure Project (CDP)

- Value Reporting Foundation/Sustainability Accounting Standards Board (SASB)*

- Task Force on Climate-Related Financial Disclosures (TCFD)

- United Nations Sustainable Development Goals (SDG)

- Corporate Sustainability Reporting Directive (CSRD)

Other reporting frameworks:

- Climate Disclosure Standards Board (CDSB)

- International Integrated Reporting Council (IIRC)

GRI currently remains the most widely accepted framework (KPMG, The Time Has Come, Survey of Sustainability Reporting 2020). Yet, in 2020, a number of our clients at OBATA reported on their ESG disclosure across multiple frameworks.

Over the coming years, there may well be a different single accepted framework or combination of frameworks that emerge as the predominant framework of choice.

Consider Ratings Submissions

Consider what Ratings Agencies to submit for: i.e. Sustainalytics, S&P, CDP, MSCI.

USEFUL TIPS:

- It is important to research and evaluate each ESG framework to best represent your company and its ESG efforts.

- Consider providing training to key team members so they can work effectively together towards common goals, with a shared understanding and set of assumptions.

- Select a partner that can help with framework index creation and support.

*The Value Reporting Foundation was formed through a merger of the Sustainability Accounting Standards Board (“SASB”) and the International Integrated Reporting Council (“IIRC”)

STEP 3: Gather and Examine Your Data

This step involves implementing the disclosures chosen from the selected framework and collecting and organizing the data associated with them. It’s important to examine the data for insights and capture for content development to support your storytelling.

Often, companies will work with a consulting firm such as OBATA to achieve this as it is important to consider the level of complexity and number of disclosures involved (ex: the GRI framework offers numerous standards and disclosures).

In many cases, the level of complexity is dependent upon a company’s goals or industry regulations.

USEFUL TIPS:

- It is important to remember that data for environmental, social, and governance reporting can come from multiple sources. These sources may include your own company, an outside consultant, or suppliers and partners.

- The most often used data organization tool is an Excel spreadsheet.

Phase 2:

The Art of the ESG Report

Once the Science is established, the Art of the ESG report shares the data, weaving a story of how it all impacts your stakeholders — your employees, shareholders, prospective and current customers, suppliers, governments, industry regulators, media, and communities.

USEFUL TIP:

- It is advisable to hire an external professional agency for these next steps to ensure impartiality and clarity in presenting the information to the target audience.

STEP 4: Content Development & Storytelling

It’s important to communicate your ESG strategy, efforts and results to address corporate goals for reporting.

This step involves writing the narratives, top-level messages, and letter from the CEO, as well as background on how your organization is approaching ESG. Often, it involves interviewing internal audiences or subject matter experts (ex: employees, management, suppliers) as well as those involved in collecting and organizing the data that will be shared in the report.

From these interviews, an outline will be constructed, and content written, edited and reviewed. This narrative makes up a great deal of the report and provides the opportunity to personalize the efforts being made by your company toward sustainable best practices.

USEFUL TIP:

- It’s a good idea to have one person manage the writing for your ESG report, to keep a consistent tone of voice throughout the report

STEP 5: ESG Report Design

Visually conveying the content in an impactful and engaging manner is critical to the overall success of your ESG report. It is helpful to develop multiple design approaches and work with a respected and experienced ESG report design firm to ensure that your report is professional, well organized, and easy to read.

A good ESG report design will include integration of your company brand standards and highlight key data through the use of infographics, charts and tables that visually tell your ESG story in an impactful and interesting way.

Consider using a landscape format for your report, which aligns with most desktop and laptop computers, reducing the need for scrolling. In 2023, the majority of Fortune 500 companies used this format.

USEFUL TIPS:

- Use draft text so you have designs that are representative of the actual content.

- The report should have a clear organizational structure and include interactive navigation.

STEP 6: Report Production & Publishing

Once the design and content are finalized, it is time to lay out the report in a user-friendly manner. This is where data is visualized as charts or infographics, and key messages and stories bring the report to life.

Once the final product is approved, printed copies may be produced, electronic PDF documents are created, and if desired, a microsite or website content page is created.

An interactive PDF report is a great way to engage your website visitors. These reports deliver interactive components that are similar to a website.

For online formats, it is highly recommended that a landing page, separate microsite, or method of integrating the report into a company’s website be developed. This will help harness the power of your website’s search engine optimization (SEO) efforts. Either of these formats will lead to more readers finding your ESG report and could lead to additional traffic to your website.

Once published, it is time to submit to the ratings organizations. This can be important to all stakeholders including investors and upstream and downstream partners.

USEFUL TIPS:

- Avoid tired visual clichés – such as the all-too-often-used “seedling in hands” image. These types of photos won’t add value or distinction to your report.

- Allow ample time for multiple internal reviews of the report once it is typeset and formatted.

STEP 7: Amplify ESG Messages

Once produced, letting the world know about your ESG report or sustainability report is the final step, but it’s not your only consideration.

You can deepen the impact of your sustainability story by involving investors and other stakeholders through ESG-focused digital marketing strategies. These strategies include awareness campaigns, promoting thought leadership, and boosting shareholder confidence through both traditional and digital media channels.

One way to further establish your expertise on sustainability is to promote your thought leadership by showcasing your sustainability accomplishments and making them more widely known.

To boost shareholder confidence, it’s essential to incorporate and communicate ESG messaging consistently across various investor communications.

Consider developing messaging and activity programs to increase ESG awareness among employees, suppliers, and partners and advance your goals.

Finally, once you’ve created and shared your ESG report or sustainability report, it is helpful to begin planning for subsequent reports. Many companies add to their ESG reports every year as their ESG or sustainability reporting needs or requirements increase over time.

USEFUL TIPS:

- Don’t limit yourself to one way of communicating your progress. While interactive PDFs are the most common, consider a microsite, social sharing of content, or updating on a quarterly or semi-annual basis.

- It is often useful to employ an outside communications firm to help spread the word.

Choosing an ESG Reporting Partner

When it comes to communicating your organization’s sustainability performance, choosing the right agency for your ESG, CSR, or sustainability reporting needs is crucial.

OBATA can be your partner in this journey by providing guidance that will help you navigate through the complexities of sustainability reporting. With our help, you can showcase your commitment to sustainability and attract investors and stakeholders who share your company’s values.

At OBATA, we specialize in helping companies effectively communicate their sustainability story, no matter where they are in their reporting journey. Our team consists of experts in strategy, content, and design, and we can create a persuasive and impactful narrative that clearly and effectively conveys your message to your stakeholders. Our goal is to empower your stakeholders to better engage with your brand and understand your commitment to sustainability.

In summary

As outlined here, the process of developing a successful ESG or sustainability report hinges on the science and art of solid, professional experience. It is critical to understand the detailed process behind the ESG report and just as critical to work with the right partners to make it a reality. Working with an ESG reporting partner who can guide you through the reporting process can improve the outcome and success of your report.